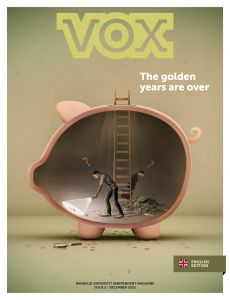

Away with the student loan system! But at what cost?

-

Illustratie: JeRoen Murré

Illustratie: JeRoen Murré

Four years after the introduction of the student loan system, politicians and opinion makers are crying out for a return to the basic grant. Their ranks include former Member of the House of Representatives Zihni Özdil, who sacrificed his political career to study funding. But who will pay the price of abolishing the student loan system?

28 May 2019. Zihni Özdil, GroenLinks spokesman for Education in the House of Representatives, has made a decision: he’s leaving. Earlier that evening, the rest of the GroenLinks representatives had also gathered to discuss Özdil’s future as Member of the House of Representatives without him. The reason was an interview in Trouw, in which Özdil called on his party to stop supporting the student loan system. As one of the architects of the student loan system, party leader Jesse Klaver in particular was not amused.

‘Within my fraction, I spent two years trying to shift our party’s position on the student loan system,’ Özdil confides to VOX four months later. ‘When I saw it wasn’t going to work, I decided to increase the pressure by making an appeal via the media.’

Why flog a dead horse, Özdil wondered in the infamous interview. ‘Even the promises that were made to make the student loan system attractive failed to materialise. The tuition fees kept on increasing, while supplementary grants lagged behind. The money saved was not invested in improving the quality of education.’

‘Only the elite are able to graduate without incurring debt’

Özdil, a historian by training, emphasises that he was never a fan of the student loan system in the first place. ‘If we as a society decide that education is a basic right, we shouldn’t build in any kind of loan system. No matter how social your loan system, it will still force a large group of students to graduate with a heavy debt on their shoulders. Only a small group – the proverbial 1% – will be able to avoid it.’

According to Özdil, the student loan system creates class division. “Only the elite are able to graduate without incurring debt. It’s not for nothing that this idea originated with Milton Friedman (economist and advocate of free market capitalism, Eds.). The left simply took over his neoliberal ideology. The argument that the baker’s son shouldn’t have to pay for the lawyer’s son studies literally comes from Friedman.”

Özdil is particularly irked by the ‘disciplining nature’ of the student loan system. ‘When you force people to enter the labour market with a huge debt, you’re effectively constraining them. People with heavy debts will take on any job to pay them off, and are much less likely to strike or join a labour union.’

Impact on life

Zihni Özdil is not the only one to take a critical look at the student loan system, often described by proponents as a ‘study advance’. Student organisations, and increasingly also political parties, are distancing themselves from it. But why? Is the student loan system really a financial noose round the neck of students?

A recent report by the Social and Economic Council of the Netherlands (SER) describes how the student loan system impacts various aspects of students’ lives, now and in the future. The number of students who live in a rented room has apparently dropped significantly since the introduction of the student loan system. Students leave their parental home on average one year later than before. Among students who still live with their parents, 40% say they can’t afford to leave home.

Then there’s the increase in performance pressure and the growing psychological symptoms among students. These are also a consequence of the student loan system, conclude researchers from the market research agency Motivaction, in a report commissioned by the Dutch National Student Association (ISO). Students with a loan are more likely to suffer from stress, they feel more tired, and they’re more likely to be forced to take a job. Motivaction writes that the health of students with a large student loan suffers. A significant minority experience anxiety and depression and there’s even an increased risk of suicide. The cause? The student loan system, combined with other factors, like the Binding Study Advice and the desire for a rich social life.

In the meantime, total student debt continues to rise. The average student debt increased from € 12,400 in 2015 to € 13,700 in 2019. The Netherlands Bureau for Economic Policy Analysis (CPB) expects this figure to continue to increase up to € 21,000 (see box).

Average student debt continues to rise

According to the Netherlands Bureau for Economic Policy Analysis (CPB), the average student debt will continue to rise to approximately € 21,000. The CPB doesn’t know when this figure will be reached – nor is there a calculation to support this prediction, explains Marcel Lever, author of the CPB memo to the NRC. ‘We simply made an educated guess, based on our expectation that half of the unawarded grants will be issued as loans.’

The number of students with a study debt is also growing. In 2019, 1.4 million students accrued a study debt, 388,000 more than in early 2015. And despite former Minister of Education Jet Bussemaker’s promise when the student loan system was introduced that a study debt wouldn’t impact a person’s ability to obtain a mortgage, the opposite is true. The Consumentenbond makes the following calculation: a single-income family with a gross income of € 40,000 a year and a study debt of € 15,000 can under current conditions borrow € 164,000. A person with the same income but no study debt can borrow almost € 20,000 more.

Summoned to The Hague

Hans Vossensteyn, former Director of CHEPS, a research institute of the University of Twente, is not surprised by these figures. CHEPS investigates higher education and has carefully compared various forms of study funding in Europe. How do changes in study funding impact accessibility of education in other countries? On the eve of the introduction of the student loan system in the Netherlands, this kind of information was badly needed. Vossensteyn was repeatedly summoned to The Hague to inform the House of Representatives and the States General.

He’s always been and remains a vocal supporter of the study loan system. ‘In my research, I repeatedly show that a large majority of students would study even without any study funding.’ Not that this would be desirable, but Vossensteyn does call for more rational decision-making when it comes to creating a funding model. ‘With the basic grant system, the government gave out € 1 billion a year. Most of this money went to students whose families could easily afford to pay for their studies.’

Vossensteyn believes this problem is solved with a student loan system: those who benefit most from their studies pay the bills. The additional grant is supposed to ensure that children from less wealthy parents can also find their way to the lecture halls. ‘The most important flaw in the current system is the amount of the additional grant (€ 396, Eds.). It’s higher than in the old system, but not high enough for children from poor families to be fully compensated for the loss of the basic grant.’ After all, these students used to get a basic grant (€ 296) and an additional grant (maximum € 283).

No evidence

However, Vossensteyn thinks it’s too early to write the student loan system off. According to the researcher, the fact that political parties are starting to dissociate from the loan system is due to the link we are increasingly making between loans on the one hand, and performance pressure on the other. But as yet there’s no real evidence that the student loan system is the culprit, says Vossensteyn. ‘Of course, students would prefer to get a grant and feel they are under more financial pressure with a loan. I’m not denying Motivaction’s findings, but I think their results primarily represent the opinions and perceptions of students.’

Vossensteyn sees other reasons for the increased pressure felt by students. The 2013 performance agreements, for example, by which universities promised to improve their study success rates. ‘At the time we felt a need to improve the quality of education. This translated to combatting drop-out and stimulating students to complete their studies within the set time through the Binding Study Advice. It also led to more intensive education, with more contact hours and more exams. No wonder students feel more pressure to perform. It’s what we, as a society, wanted.’

‘No wonder students feel more pressure to perform. It’s what we, as a society, wanted’

Nor can we conclude that the student loan system makes education less accessible. In September, Minister Ingrid van Engelshoven sent the House of Representatives a report by ResearchNed showing that the percentage of secondary school pupils who attend university has remained essentially unchanged since 2015. There’s been a slight drop in the number of MBO graduates attending universities of applied sciences, but this trend is levelling off. The results of the ResearchNed report therefore largely match the insights gained by Vossensteyn in the course of his international research on study funding: people having to borrow money to study, due to higher costs or grants no longer being available, has little or no impact on participation in higher education in the long run.

Özdil has reservations about the conclusions of ResearchNed’s report. ‘Of course, the student loan system doesn’t obstruct access to higher education – neither does it do so in the US, where tuition fees are tens of thousands of dollars a year. Hardly anyone says: I’m not going to university if it means I have to borrow money. Instead, young people reluctantly accrue debts, because a university degree creates opportunities on the labour market. I’m concerned about the heavy debt burden on young people as they enter the labour market.’

What about students living at home longer? Is that a consequence of the student loan system? ‘It could be,’ says Vossensteyn. ‘The basic grant did make it much easier to move out. Now students have to make a more conscious decision. I don’t think it’s a bad thing. Look at the Amsterdam-based universities: most students there come from the Amsterdam region, yet 80% rent a room. Is that really necessary, when their parents live 3 km away? And if it is, is it something we as a society should be paying for?’

Re-introducing the basic grant five years after its abolition would be a mistake, says Vossensteyn. ‘The costs will be met by the taxpayer. These are the people who over the past years have had to deal with rising healthcare costs and cuts in retirement funds. Some of them never went on to higher education themselves. Is it really fair to make them pay for this?’

Come to their senses

Among House of Representatives members, the answer increasingly seems to be: ‘Yes’. Political support for the student loan system is disintegrating. Less than two weeks after Özdil’s departure, GroenLinks Leader Jesse Klaver also turned his back on the loan system. In early September he was followed by PvdA and on the same day, Rob Jetten (D66) announced that his party did not consider the student loan system an aim in itself. The only party that hasn’t yet reneged on the loan system is VVD.

‘I’m happy that PvdA and D66 seem to have come to their senses’

‘I’m happy that PvdA and D66 seem to have come to their senses,’ says Özdil. As a columnist for NRC and Vrij Nederland he plans to keep a close eye on these parties. ‘Woe betide if one of them tries to build a loan component into their party programme in preparation for the next national elections. I’ll be sure to devote a couple of articles to it.’

The student loan system has cost him his head, concludes Özdil. ‘But if it’s abolished soon, it will have been worth it.’

‘Radboud University made good on its promises’

An important promise the government made when abolishing the basic grant was that the money saved would be redirected into education. After all, abolishing the basic grant was not a cost-cutting operation, but intended to improve the quality of education.

The Ministry faced one small problem: the funds would only start to be released slowly in 2018, the year the first group of ‘student loan system’ students was due to graduate. So an agreement was reached that universities would advance money from their own funds, € 200 million in total, over a period of three years.

Radboud University was also required to make an advance investment, with the support of the co-participation bodies. The discussion preceding this decision did not go particularly well. The student Council was outraged that some of the advance funds would be going to the Radboud Honours Academy – an excellence programme that only benefits a small percentage of students.

Since such discussions were raging not only in Nijmegen, but at nearly every Dutch university, the Netherlands Court of Audit decided to examine in detail how the advance study funds were spent. The research universities and universities of applied sciences reported spending € 860 million in advance investments. The Court of Audit made short shrift of this, concluding that only one third of these millions were actually spent on additional expenditures in the context of the basic grant funds.

The Court did approve the advance investments made by Radboud University. According to its own calculations, the Nijmegen Executive Board spent € 31.6 million in the first three years of the study loan system. The Court of Audit concluded that 88% of these expenditures were ‘legitimate’ and 12% ‘partially legitimate’. It means Radboud University more than made good on its promises. An interesting detail: the investments in the Radboud Honours Academy were considered ‘legitimate’ by the Court of Audit.

The impression that is sometimes created that students don’t benefit from these advance investments is ‘painful’ and ‘completely unjust’, says Vice President Wilma de Koning. ‘We take our responsibilities as a Board very seriously. In the years to come, we will continue to shift funds arounds, so students are able to benefit sooner from the funds that become available. The money we’re due to receive in 2021 is already included in our 2020 budget.’

The study advance funds that the University receives as an additional form of government funding will continue to increase in the coming years, reaching nearly € 16 million in 2024. With one caveat: that the student loan system still exists by then.

The new Vox, with ‘money’ as theme, will appear online on Thursday. From that day on, the magazines will also be distributed on campus.