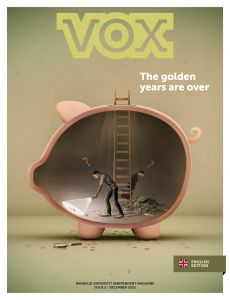

Going back home, because you’ve run out of money

-

Parker Winkel (20, USA), has taken out a loan a loan from a US bank.

Parker Winkel (20, USA), has taken out a loan a loan from a US bank.

Studying abroad is not only an enriching educational experience – but also an expensive one. So, how do the 2580 international students currently enrolled at Radboud University finance their stay in Nijmegen?

New Vox

This story is part of the new Vox magazine, which is all about money and now available on campus. After some good years, the university is back to budget cuts. And not just the university, but its students as well, with the cost of living on a steep incline. Fortunately, the return of the basic study grant can help to stop the bleeding.

Whether through governmental aid, private loans, scholarships, part-time jobs, or family support – when it comes to international student financing, many roads lead to Rome. Or, more precisely, to Nijmegen. Some student finance is not only notoriously generous, it can also be taken abroad. For a single Icelandic student, for example, the monthly student finance by the Icelandic state that a student can take to the Netherlands amounts to a whopping €1,555.72 per month in 2023 – not including an additional grant to cover tuition fees.

High fees

Many international students, however, don’t receive any governmental student finance and are entirely dependent on alternative forms of financing, including scholarships. The latter is especially crucial for non-EU students who pay the much higher institutional tuition fee that can amount to an annual €22,000 for some studies.

Because of that, the most competitive Radboud scholarships are aimed at these non-EU students; these include the Radboud Scholarship Programme and the Radboud Encouragement Scholarship, established in 2008 and 2021 by a decision of the Executive Board. The scholarships respectively offer either partial or full funding of those higher tuition fees, and also cover some additional costs.

And then there are some faculty scholarships. One of them is the scholarship awarded to international students, either from within the EU or outside of it, in the Research Master in philosophy. ‘Sometimes, we have a candidate we would like to offer our faculty scholarship to, but even with the scholarship, they wouldn’t be able to come here because it covers only part of the costs,’ explains Frank van Caspel, coordinator of the philosophy Research Master.

Many international students don’t receive any governmental student finance

When the faculty’s scholarship isn’t enough, the department has opted in the past to combine its own scholarship with a university-wide scholarship like the Radboud Scholarship Programme. This year, four international students are receiving their faculty’s scholarship for the philosophy Research Master – quite a high number, considering that only 17 international students are currently enrolled in the programme.

Name: Parker Winkel (20) – photo on top of this article

Country of origin: USA

‘By the end of my first year, my money was running out and I was starting to panic. Until then, I had lived off my savings. In the U.S., we have Federal Student Aid (FSA).

Radboud, however, isn’t eligible for FSA, because it never applied for it. Other universities in the Netherlands, Maastricht for example, are eligible. So, for my second year, I had to take out a private loan. I finally found just one bank in the entire state of Virginia that would lend me money – without breaking my kneecaps if I couldn’t pay them back!

‘I think it’s perfectly reasonable to cut down the number of students that go to university’

This year, I joined the Student Council, partly because I wanted to campaign for Radboud applying to become an FSA-eligible school. This would make a huge difference for a lot of American students – you can take out a bigger loan, the interest rate is lower than for a private loan and you can defer it. And I believe it would be a financial gain for Radboud as well. More Americans would apply and pay the high institutional tuition fees.

You can obviously make the case that we don’t have the space and that we’re already overrun. Frankly, I think it’s perfectly reasonable to cut down the number of students that go to university, but the basis on which they are admitted should never be their ability to afford it.

Right now, delaying my studies is not an option, because I won’t be able to lend more money to cover the costs for even a single additional semester. By the time I graduate with my Bachelor’s, I will have run up a debt of around 30,000 dollars.

If Radboud were to become an FSA-eligible school within the time frame of this year, I would love to stay on for my Master’s. But I’m not confident enough to believe that this will happen and that I will be able to benefit from this by next year.’

Name: Lisa Adler (20)

Country of origin: Duitsland

‘I finance around 80% of my studies through Bafög, which is the German state’s student loan, similar to the Dutch DUO. At present, I receive €720 per month. To apply for Bafög, you have to go through a very extensive procedure, you have to re-apply every year and whether you receive it depends a lot on your parents’ income.

On top of that, it takes them a very long time to process your request. Last year, I re-applied for my Bafög in July, as I wanted to receive it by the time the new study year started in September. In the end, I had to wait until February before I got any money – and I’m not the only one who had issues like that.

I had to live off my savings, ask my parents for help, and borrow money from my stepsister. I wanted to do an Erasmus exchange during my third year, but because I’d used up my savings and didn’t know when I would receive the money, my financial situation was too insecure to apply for it.

I can’t even imagine what this must be like for people who don’t have any savings or supportive parents. Even during the application process, you need a lot of information from your parents – and that can put unnecessary pressure on young people who aren’t on good terms with them. I think the application process being so complicated stops a lot of people from getting the financial help they deserve. It’s not a very accessible system. It sometimes almost feels as if it’s working against you – they don’t want you to get the money you are legally owed.’

Name: Tanima Nimaga (27)

Country of origin: India

‘Financial support was the most important factor determining my choice of study. I’m originally from India and I’m currently doing a Research Master in philosophy fully funded through the Radboud Encouragement Scholarship. That means that my tuition is paid for the duration of the programme and that my visa, immigration and residence permit fees and student insurance package are all covered. In addition to that, I also get a stipend of €960 per month to cover my living expenses.

‘I can’t really put any money aside for emergencies’

Being awarded a scholarship can be very competitive because there is only a certain number of placements for each faculty. I got the only one that was available for the Faculty of Philosophy, Theology and Religious Studies. And you do, of course, have to do some extra work and submit a separate application for the scholarship in addition to your application for the Master’s.

Despite the scholarship covering quite a lot, money can still be tight. I can’t really put any money aside for emergencies. One way to save up is to work, but as a non-European citizen, you need to apply for a work permit, which takes time. You also need to have basic Dutch health insurance to be able to work and the premium for that won’t be covered by the scholarship.’

Did you know?

Some international students from within the EU are also eligible for Dutch student finance (DUO). Internationals enrolled at a Dutch university are, for example, eligible if they have lived in the Netherlands for five consecutive years, work for at least 32 hours a month or have an income of at least 50% of the social security norm (in 2023, 50% of the norm is €597.83 per month, €147.60 if you are younger than 21). For more information, visit the DUO website.