Green University, green bank? Why Radboud keeps its money at non-sustainable banks

-

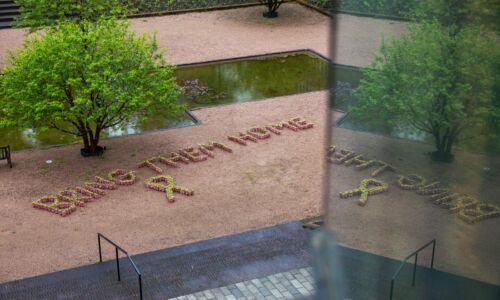

Campagnebeeld van de Radboud Universiteit

Campagnebeeld van de Radboud Universiteit

Protesters recently called on universities and universities of applied sciences to use sustainable banks. That is not a simple matter, however. How sustainable is Radboud University’s financial management, and how can it be improved?

Radboud University is very ambitious when it comes to sustainability, but the same cannot be said for the banks and insurance companies the university patronises. According to Studenten voor Morgen, Scientists for Future, and the Young Academies, it is high time that changes. They sent an open letter to all Dutch universities and colleges at the end of January, in which they pushed for sustainable banking practices.

‘Financing fossil fuels does not fit the goals set by universities, which aim to serve the public interest’, states Marjan Smeulders, microbiologist at Radboud University and one of the letter’s co-signers. As part of Scientists for Future NL, Smeulders advocates in favour of financing that does not involve fossil fuels. ‘One of the ways in which we can accomplish this is by calling on our own institutions to take action. That really works, as we’ve seen with pension fund ABP.’

‘The major financiers can play a massive part in the energy transition’

Scientists for Future gave a similar call to action in March of 2021, to pressure ABP into stopping its investments in fossil fuels. Dutch universities set up a scientific committee, and at the end of 2021 ABP announced that it would stop investing in products made from fossil fuels. Smeulders states that banks and insurance companies were a logical next step for the action group. ‘They are the world’s major financiers, so they can play a massive part in the energy transition.’

Smeulders is by no means dissatisfied with the measures Radboud University has taken when it comes to sustainability. ‘For example, the new hybrid energy system has already drastically reduced gas usage on parts of campus. The university is already doing a lot of things right, but their financial policy could be improved.’

No A-1 rating

What does that financial policy currently look like? Marije Klomp, programme director of sustainability, informs us that the university possesses several bank accounts at ABN AMRO, ING, and Rabobank. None of those banks pass muster, according to the Eerlijke Bankwijzer (a website that rates banks on their sustainability efforts, e.d.); ING scores especially poorly. The university’s insurance policies are handled by AON, a company that is not part of the Eerlijke Geldwijzer for insurers. Additionally, the university makes use of what is known as ‘treasure chest banking’, meaning that funds obtained from the government are kept in the Ministry of Finance’s account. Every transaction to- and from that account uses an in-between account at a commercial bank that the university patronises.

Due to this banking method, the university is subject to governmental regulations. For example: the in-between account needs to be held by a bank with at least an A-1 rating; a kind of risk measurement, according to Bert Scholtens, professor in sustainable banking at the University of Groningen. ‘That rating judges the risk that banks are unable to fulfill their obligations.’ In the past, some banks bragged about their ‘triple-A status’, but all banks’ ratings have plummeted since the financial crisis.

Sustainable banks don’t have an A-1 rating, according to Klomp. ‘That means it’s not currently possible to switch to a completely sustainable financial organisation.’ But things are looking up: Scholten points out that the Volksbank, part of which is the sustainable ASN Bank, does now possess that coveted A-1 status. In an update on October 26th, 2022, rating agency S&P announced that they were upgrading the Volksbank from A-2 to A-1. However, there is an additional obstacle that precludes the use of the Volksbank, as stated by Annet Les, spokesperson for the university: the Volksbank is currently focusing on individual clients and smaller companies. In other words: the university is too big to be a customer.

Talk or walk

Smeulders thinks that leaving non-sustainable banks and insurers sends a clear signal, but she understands that it’s not always that simple; not just because of governmental demands, but also because of multi-year contracts that can’t easily be breached. ‘That is why we mostly expect universities to have a discussion with their banks and insurers, and that they will advocate for changing policies.’ Even if business relations won’t budge an inch, that at least shines a light on the issue. ‘And if there is a new tender at the end of a contract, we ask the university to take sustainability into consideration as part of the process.’

Changing banks is not in the cards for the foreseeable future. However, according to Klomp, the university does hold regular meetings with bank relations that feature sustainability as a point of discussion. Scholten understands the choice to talk, rather than walk. ‘Banking is all about trusting, long-term relationships. If there is something in that relationship that has one of the parties concerned, it should be discussed. If a friend is acting in an unpleasant manner, you wouldn’t just cut them out of your life. The same is true for business relationships.’ Not only that, but universities inherently have an educational task. ‘Thus, it makes sense that they would also try to (re)educate their suppliers.’

According to Scholten, banks are not averse to sustainable sentiments. ‘But acting on them is another thing.’ In the past few decades, Scholten did not see a significant shift towards sustainable investments by non-green banks. ‘There are two concepts involved in this: markets and regulations. You can’t expect the market to fix a problem it has created itself; commercial ventures will always prioritise profits. That is why you need regulations to counteract those priorities, though those are not always as effective. Markets are not perfect, and neither are regulations.’ Another factor is the financial sector’s enormous influence. ‘It has often taken years of discussions between lawmakers and the sector before any regulations were implemented.’

Investments

However, Scholtens still thinks that it can be beneficial if major clients push their banks for changes in policy. ‘It would be a good thing if universities were to collaborate on the issue; that way, they can offer more resistance.’ And, as stated in a response by the UNL (Universities of the Netherlands), that indeed seems to be the plan. According to UNL spokesperson Ruben Pluyaert, last Thursday, the umbrella organisation sent a request to the Dutch Banking Association, as well as the Insurer’s Association, to discuss sustainability issues. Whether this will have an effect similar to the pension fund ABP, only time will tell.