A look into students’ finances: ‘Food is my biggest expense’

-

Heske Boeve, Victor Bruynel and Dana Baars. Photos by Johannes Fiebig

A debt of €50,000 is no exception for the 'unlucky generation', as they can't make ends meet without loans. How do their monthly expenses look like? Dana, Victor and Heske offer a unique look into their finances.

Dana Baars (20), Bachelor’s programme in Communication Science

‘I’ve really got no idea how much I pay for things. I don’t have any money worries; in that respect, I feel privileged compared to other students. I don’t have to borrow money because I get both the basic grant and a contribution from my parents. In the supermarket, I do choose the cheaper products and I often ask myself whether I really need that expensive piece of salmon.

Still, food is definitely my biggest expense. Especially on a night out, I can work my way through quite a few durums and croquettes. I do save more on other expenses, such as clothing. I only buy a turtleneck sweater if I actually need it. And I don’t let myself be swept away by trends or sales. I attach more value to fun experiences, like festivals. That’s something I can easily spend a lot of money on.

I recently got a keyboard for my room. I bought it on Marktplaats for €275. I do think carefully about big purchases; that’s something I learnt from my parents. Don’t buy unnecessary things. Unfortunately, that doesn’t always work out: I recently bought an orange mushroom lamp from SHEIN for €40. That was a really bad buy, because I find the lamp really ugly. Still, it didn’t occur to me to return it, and ask for my money back.’

Victor Bruynel (23), Pre-Master’s programme in Communication Science

‘Since last summer, I am a board member at student tennis association Slow. So, I’ve got less time for work this year than in previous years. I’ve got a part-time job as a sales assistant at Blokker, which is partly where I get my money from. Being in my seventh year of study, this is the last year I can borrow money from DUO. I borrow as much as I can. I still have to figure out how I will get money after that.

‘The money I get for my year on the board is also nothing to write home about’

I also get money from my parents because I’m not entitled to the basic grant and because I suffered from financial stress, like lots of other students. I’m lucky that my parents can help out, but I find it hard to ask them for money. I just think I should be able to take care of myself, financially.

The money I get for my year on the board is also nothing to write home about, and I don’t get it paid into my account until the end of the academic year anyway. But of course, board work isn’t something you do for money. This year, I moved out of my parents’ house, and I joined a student sports club. Those are both extra expenses, but they are well worth it to me.’

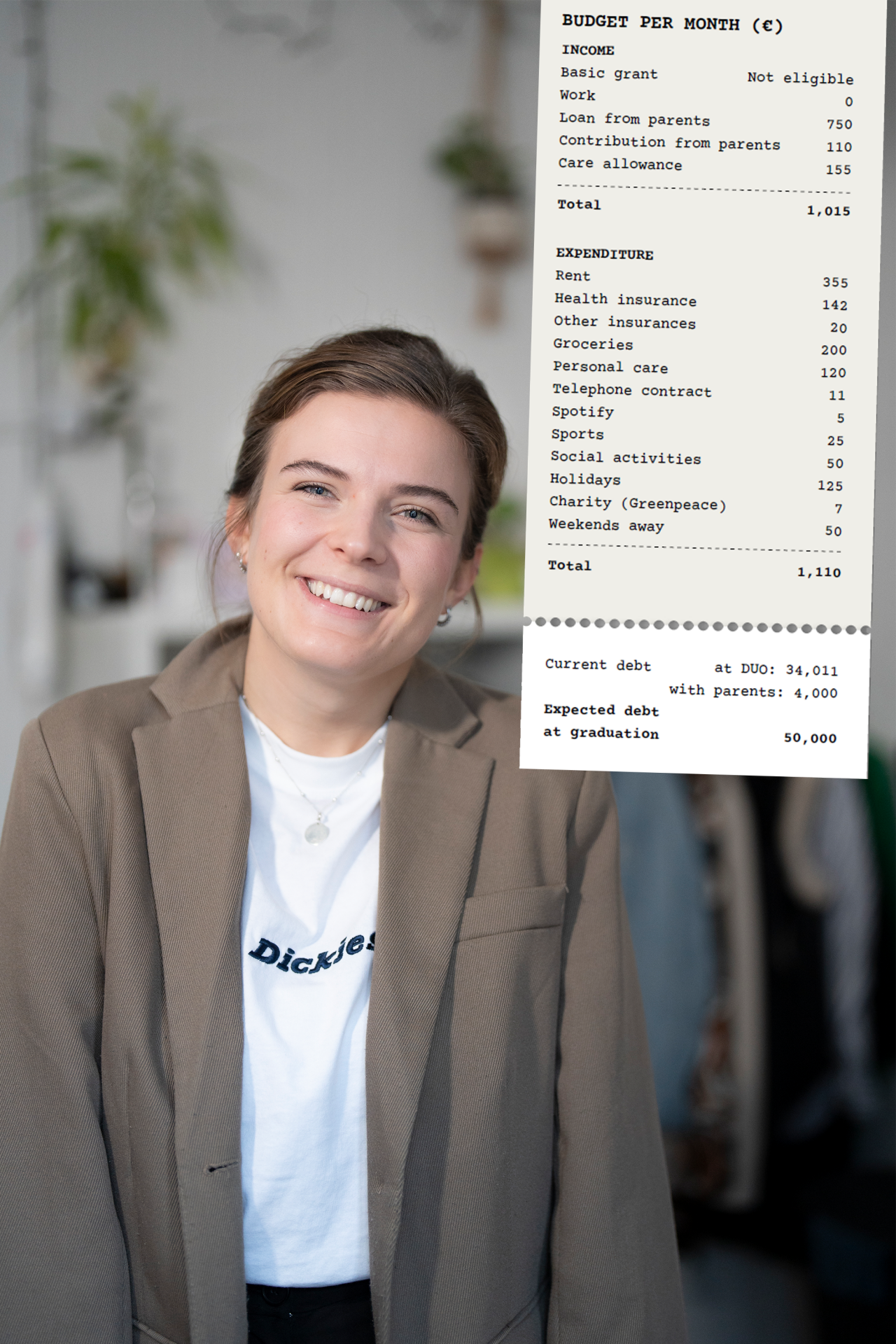

Heske Boeve (23), Master’s programme in Environment & Society Studies

‘Because of the interest rate being raised to 2.56%, I stopped borrowing money from DUO. I’ve already accumulated a substantial debt at DUO, of over €34,000. Now I borrow from my parents, at no interest. During my Bachelor’s study programme in Groningen, I really lived like a student: I spent a lot of my money on beer and going out. But now that I am doing my Master’s, I’m far too busy for that. I don’t have a specific budget for social activities, especially now I’ve moved to a new city. I see such activities more as an investment in meeting new people, which is worth every penny to me.

I can honestly say that my student debt combined with this recent interest rate increase do make me nervous about the future. How am I going to manage it all later? Will I still be able to buy a house?

My best purchases are my phone and my laptop. Especially my phone, which I bought second-hand and which has already lasted five years. My best money tip for students: check your phone contract, because there are much cheaper deals to be had. I switched to another provider and I now pay half as much, only €11. It’s a question of comparing different providers. And make a savings plan. That way, you really become a lot more aware of your spending.’