Making ends meet with 1000 euros a month

-

Roel Veenstra. © Duncan de Fey

Roel Veenstra. © Duncan de Fey

One student takes out a maximum student loan, without being worried about creating an estimated 70.000 euro debt. The other hopes his laptop won't break again, because he's afraid of the financial consequences. Students lay out their monthly expenses.

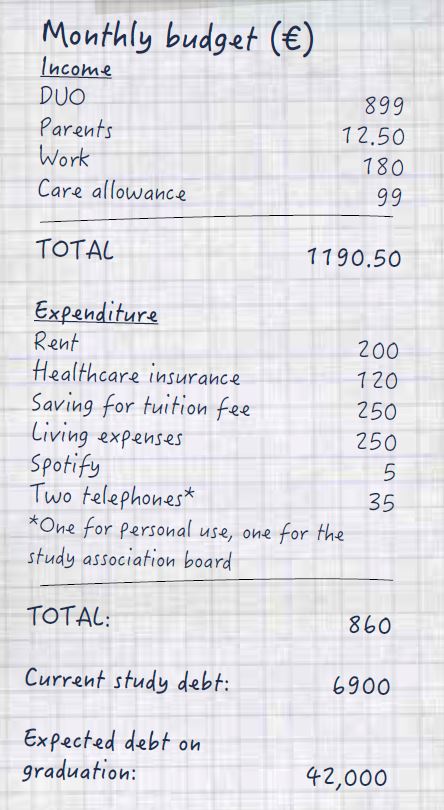

Roel Veenstra (19), English Language and Culture

‘I keep track of what I spend in my head and with a banking app, but I don’t know exactly where every cent goes. Every Wednesday I transfer € 50, or sometimes a little more, to my current account. I keep the rest in saving jars. If you don’t have it, you can’t spend it. I’m worried about my future study debt, but my main worry is my current financial situation. For example, my new laptop broke down almost straightaway, which was difficult. I do have a room with a very low rent; I’m really lucky there. The € 12.50 from my parents is the pocket money I used to get; they never stopped paying it. I’m not going to tell them about it, that’s for sure! My parents support me where they can, but not financially. The thing I’m most afraid of is some big, unexpected financial setback, because I don’t have anyone I can fall back on financially. I would have to take a loan from the bank, or in the worst case stop studying.’

‘I keep track of what I spend in my head and with a banking app, but I don’t know exactly where every cent goes. Every Wednesday I transfer € 50, or sometimes a little more, to my current account. I keep the rest in saving jars. If you don’t have it, you can’t spend it. I’m worried about my future study debt, but my main worry is my current financial situation. For example, my new laptop broke down almost straightaway, which was difficult. I do have a room with a very low rent; I’m really lucky there. The € 12.50 from my parents is the pocket money I used to get; they never stopped paying it. I’m not going to tell them about it, that’s for sure! My parents support me where they can, but not financially. The thing I’m most afraid of is some big, unexpected financial setback, because I don’t have anyone I can fall back on financially. I would have to take a loan from the bank, or in the worst case stop studying.’

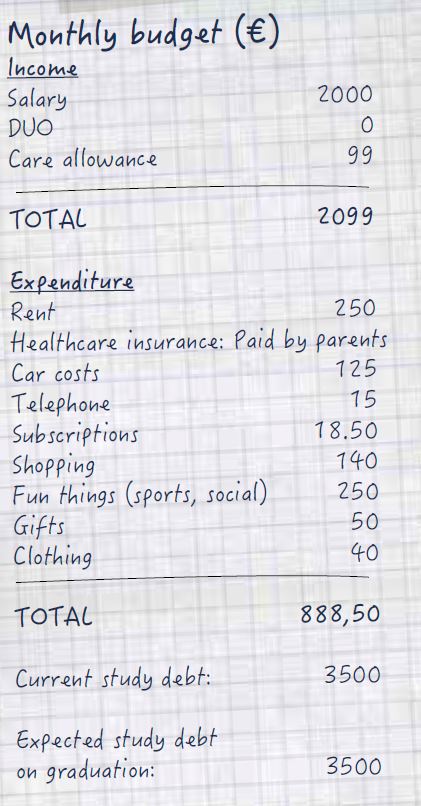

Kirsten Kingma (23), Computer Science

‘I don’t have any money worries at the moment, because I work full-time. I work at two schools as a computer science teacher. I’ve still got to complete my Bachelor’s, but the only thing I got left to do now is write a thesis. After that I plan to enrol on the Master’s Teacher Training. I’ve always had jobs on the side: tutoring, shelf stacking, at Mediamarkt, or as a student assistant. As a result, I’ve never had to borrow large amounts of money, so my study debt is very low. Now that I earn more, I’m saving lots of money, for a mortgage later. Whenever I’m tempted to make an impulse purchase, I ask myself whether I really need the article in question. If the answer is no, I usually don’t buy it. If in future I do buy something special, I’d like a sports watch or a silk duvet cover. These seem like real luxuries to me. Sharing a flat also helps save money: you share the costs of rent, shopping and subscriptions like Spotify or Netflix. My most expensive possession is my car: I bought it second-hand for € 2700. I’m picking it up tomorrow – can’t wait!’

‘I don’t have any money worries at the moment, because I work full-time. I work at two schools as a computer science teacher. I’ve still got to complete my Bachelor’s, but the only thing I got left to do now is write a thesis. After that I plan to enrol on the Master’s Teacher Training. I’ve always had jobs on the side: tutoring, shelf stacking, at Mediamarkt, or as a student assistant. As a result, I’ve never had to borrow large amounts of money, so my study debt is very low. Now that I earn more, I’m saving lots of money, for a mortgage later. Whenever I’m tempted to make an impulse purchase, I ask myself whether I really need the article in question. If the answer is no, I usually don’t buy it. If in future I do buy something special, I’d like a sports watch or a silk duvet cover. These seem like real luxuries to me. Sharing a flat also helps save money: you share the costs of rent, shopping and subscriptions like Spotify or Netflix. My most expensive possession is my car: I bought it second-hand for € 2700. I’m picking it up tomorrow – can’t wait!’

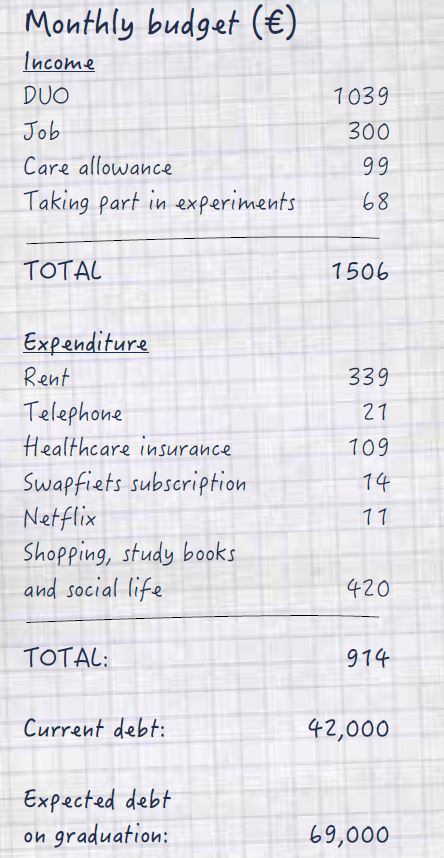

Joni Visser (23), Master’s in Constitutional and Administrative Law

‘I’m not worried about my study debt. There’s no point in worrying about the future. That doesn’t mean I’m irresponsible; I do try to be careful. I put money aside every month for unexpected expenses, and I try to save as much as possible. I take part in a PIN savings programme, a service offered by ABN AMRO. Every time you take money out of a cash dispenser, 10% of the amount is automatically transferred to a savings account. In this way, you can save automatically, which is really convenient! I use the cash dispenser a lot, because I sometimes pay for my shopping with cash. If the total amount is € 10.01, they round it down so you’re better off paying cash. If it’s € 9.99, you’re better off paying by card. That way you save a bit of money. And I don’t own a laptop; I manage fine with the University computers. I watch Netflix on my phone. My most expensive possession is my coin collection – I’m a collector. I also have collections of beer mats, bottle caps, cigarette packs and foreign currency. The coolest thing I own is a banknote from North Korea, which a friend brought back for me illegally. I would never sell my collections.’

‘I’m not worried about my study debt. There’s no point in worrying about the future. That doesn’t mean I’m irresponsible; I do try to be careful. I put money aside every month for unexpected expenses, and I try to save as much as possible. I take part in a PIN savings programme, a service offered by ABN AMRO. Every time you take money out of a cash dispenser, 10% of the amount is automatically transferred to a savings account. In this way, you can save automatically, which is really convenient! I use the cash dispenser a lot, because I sometimes pay for my shopping with cash. If the total amount is € 10.01, they round it down so you’re better off paying cash. If it’s € 9.99, you’re better off paying by card. That way you save a bit of money. And I don’t own a laptop; I manage fine with the University computers. I watch Netflix on my phone. My most expensive possession is my coin collection – I’m a collector. I also have collections of beer mats, bottle caps, cigarette packs and foreign currency. The coolest thing I own is a banknote from North Korea, which a friend brought back for me illegally. I would never sell my collections.’

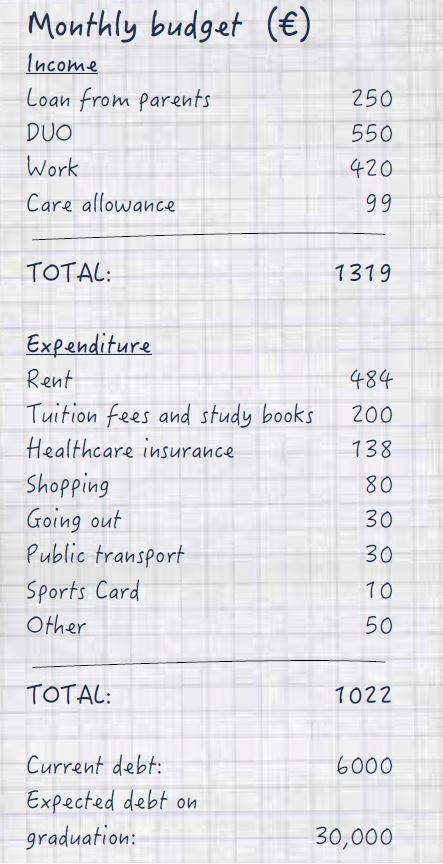

Laurie Marsman (21), Psychology

‘Last year I kept track of every single cent in my budget. I had a maximum loan at the time and was still in the red all the time. It wasn’t a good time. Now I’ve got a great job at the International Office of the University, which luckily give me some more breathing space. I save most money on shopping: I buy everything in bulk and freeze it in portions. I also get a lot of vegetables from my parents’ garden. With a bit of creative thinking, I can manage my other expenses. My study debt is now approximately € 6000, and I also owe my parents money because I went to secondary school in England. It was really expensive, and I couldn’t borrow money from DUO for this. But I assume the investments I make now will be repaid in the form of a well-paid job. Plus, I’m already repaying my DUO debt here and there when I have some money left over – the interest rate on my savings account is really low anyway.’

‘Last year I kept track of every single cent in my budget. I had a maximum loan at the time and was still in the red all the time. It wasn’t a good time. Now I’ve got a great job at the International Office of the University, which luckily give me some more breathing space. I save most money on shopping: I buy everything in bulk and freeze it in portions. I also get a lot of vegetables from my parents’ garden. With a bit of creative thinking, I can manage my other expenses. My study debt is now approximately € 6000, and I also owe my parents money because I went to secondary school in England. It was really expensive, and I couldn’t borrow money from DUO for this. But I assume the investments I make now will be repaid in the form of a well-paid job. Plus, I’m already repaying my DUO debt here and there when I have some money left over – the interest rate on my savings account is really low anyway.’