Pension fund ABP will stop investing in fossil fuels: ‘This is the first step’

-

Via: Pixabay.

Via: Pixabay.

Pension Fund ABP has announced that they will stop investing in oil-, coal- and gas companies. Climate expert Heleen de Coninck, who is a member of a scientific committee advising ABP on sustainable investments, thinks that the fund is sending out the right signal. ‘But they’re not there yet.’

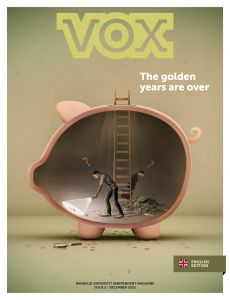

A growing pile of climate reports, cries for help from the scientific community, and the rising sea level: these are all signs that fighting climate change is becoming a more and more urgent. Pension fund ABP, whose members include employees from Radboud University and other Dutch universities, appears to heed these signs with the announcement that they will cease investments in oil- and gas companies. Their goal is to have sold all their investments in the fossil fuel industry by April 2023.

Societal Pressure

Heleen de Coninck, professor at the TU Eindhoven and associate professor at the Radboud University, has been a member of a three-headed committee since last June; this committee was set up by the VSNU, and it advises ABP about investments. She thinks the announcement is a good start. De Coninck states: ‘But they’re not there yet. This is the first step in a long process of sustainability.’

For example, ABP is still pouring billions into the automobile industry, which contributes to CO2 emissions through its products. ‘That is why ABP states they will continue to invest in these businesses but does want to have more insistent discussions with them to bring their activities in line with the Paris Agreement’, according to De Coninck. ‘After all, those investments will also need to change in the long term.’

‘ABP was pressured from all corners’

It was not just the climate reports that inspired ABP to make this radical about-turn. According to De Coninck, climate groups and pressure from ABP members (see insert) played a major role. ‘When the call to action from society gets louder and louder, it becomes hard to ignore. ABP was pressured from all corners, from civil servants to teachers. And if their members disagree about what is being done using their pensions, ABP will have to listen in the end.’

Increasing Energy Prices

As stated by de Coninck, the potential negative consequences of these kinds of decisions will need to be taken into account. ‘You can close the tap on one side, but if a lot of funds simultaneously stopped investing and fossil fuel companies suddenly had trouble finding capital, that could lead to a sharp increase in energy prices. This is especially true for low-income households,’ the climate expert says.

‘You can’t get a new energy system overnight’

‘You can’t get a new energy system overnight, but fortunately the transition has begun. ABP understands that responsibility, but that makes it a complex situation. You have to consider both sides of the story.’

Protest against ABP investments

The decision to stop investing in fossil fuel industries did not come out of the blue. There were many protests against pension fund ABP’s investments in the past – including in Nijmegen.

Groenlinks urged Nijmegen, the university, and ABP to stop these polluting investments in 2015. They felt that a university where people are researching climate change, sustainable technology, and economic transitions should set an example. Last year, Wilma Koning, the vice-chair at the time, called ABP’s investments into question.

Eearlier this year, scientists of the Young Academies became embroiled in the discussion. They wrote a letter to all Dutch universities in which they expressed their feeling that the universities’ executive boards should put pressure on ABP.